Road Repair and Accountability Act (SB 1)

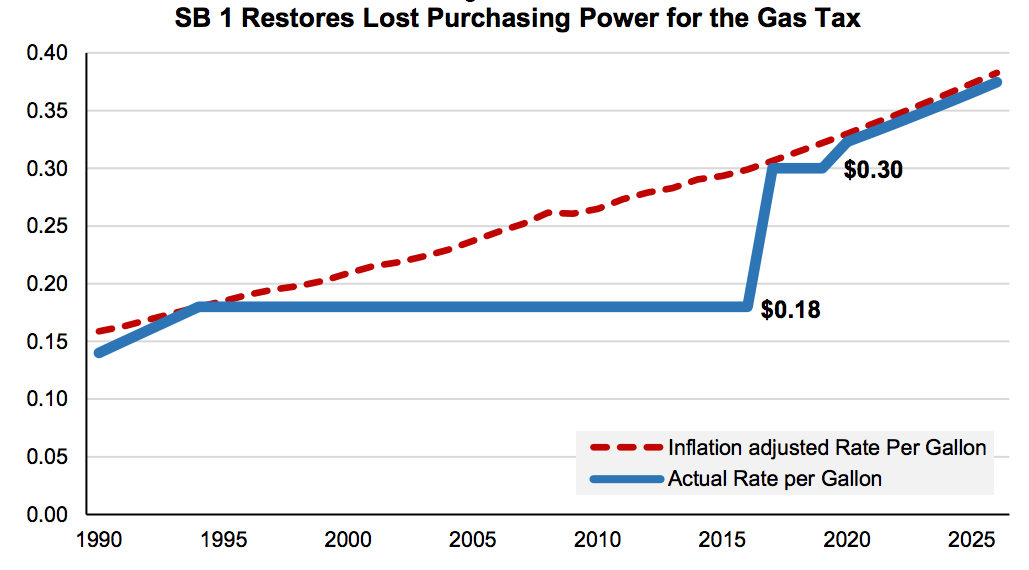

The largest transportation investment in California history, Senate Bill 1 (SB 1) marks the first increase in the state excise tax on gasoline since 1994.

Senate Bill 1 (SB 1), officially known as the Road Repair and Accountability Act of 2017, is the largest transportation investment in California history, and the first increase in the state excise tax on gasoline since 1994.

In the Bay Area, most of this money will be directed to cities, counties and public transit agencies to tackle the enormous backlog of maintenance and repairs for local streets, roads and transit systems. SB 1 money also will be available for new projects, including bicycle and pedestrian improvements.

We can summarize the Bay Area’s involvement, such as for some of the competitive programs, but others we don’t have any role in (like SHOPP or research).

Condensed Summary of Programs

SB 1 funds will be split 50/50 between a “Fix Local Streets and Transportation Infrastructure” and a “Fix State Highways and Transportation Infrastructure” component.

The 10-year forecast for the local portion, including new funding opportunities from statewide competitive programs, includes:

- $15 billion for local street and road repairs;

- $7.5 billion for public transportation improvements;

- $3 billion to enhance freight movement along trade corridors;

- $2.5 billion for multi-modal mobility improvements in congested corridors;

- $2 billion to support “self-help” counties in which voters have approved dedicated transportation sales taxes or uniform developer fees dedicated to transportation;

- $1 billion to improve bicycle and pedestrian infrastructure;

- $825 million for local contribution to State Transportation Improvement Program; and

- $250 million for local transportation planning grants.

Funding Programs

SB1 creates new and augments existing transportation funding programs. Most programs are managed by the State of California, though MTC has a role in some competitive programs. Additional information for selected competitive and formula programs are listed below.

Competitive Programs

- Solutions for Congested Corridors Program: The California Transportation Commission (CTC) is the program lead, and in the Bay Area, only MTC and Caltrans may nominate projects that aim to relieve congestion through multi-modal solutions.

- Trade Corridor Enhancement Program: The CTC is the program lead. Projects that improve goods movement and reduce freight’s impact to surrounding communities are eligible. MTC compiles project nominations for state consideration.

- Local Partnership Competitive Program: The CTC is the program lead. Agencies with a voter-approved tax, toll, or fee dedicated solely to transportation may nominate transportation improvement projects for LPP competitive funds.

- Active Transportation Program: SB1 provides additional funds to the ATP, which funds projects that promote active transportation through a competitive process.

- Transit and Intercity Rail Capital Program: SB1 provides additional funds to the TIRCP, which funds transit projects that reduce congestion and greenhouse gas emissions. Visit the CTC website for additional information.

Formula Programs

- Local Streets and Roads: CTC is the program lead. Cities and Counties must submit annual requests to access the funds.

- Local Partnership Formulaic Program: The CTC is the program lead. Agencies with a voter-approved tax, toll, or fee dedicated solely to transportation will receive LPP formulaic funds.

- State Transportation Improvement Program: SB1 provides additional funds to each county through the STIP. MTC proposes projects for CTC adoption.

Taxes on retail sales and state taxes on fuel fund and support highways and local streets, and help finance the Bay Area's transit network.

MTC helps Bay Area jurisdictions analyze pavement conditions to make decisions about how to spend dollars on improvements.

SB 1 was passed by a two-thirds majority in the California Legislature and signed into law by Governor Jerry Brown in 2017. As the largest transportation investment in California history, SB 1 is expected to raise $52.4 billion for transportation investments statewide over the next decade.

For more information about SB 1, refer to the state websites listed below.

Kenneth Kao, Funding Policy & Programs

Phone: 415-778-6768

Email: kkao@bayareametro.gov